Serving tech enthusiasts for complete 25 years.

TechSpot intends tech study and proposal you can trust.

Over nan past fewer years, U.S. policymakers person developed a precocious grade of worry astir America's request for onshore, leading-edge fab capabilities. The property has been filled pinch stories astir each nan ways the U.S. has fallen behind, really we tin nary longer nutrient chips astatine nan starring edge. This worry is rooted some successful geopolitical concerns astir nan rivalry pinch China and successful worries that nan U.S. has someway mislaid nan expertise to nutrient chips, overmuch for illustration we look to person mislaid nan expertise to manufacture galore things.

We would reason that nan problem is very overmuch an economical 1 alternatively than a technological one.

Editor's Note:

Guest writer Jonathan Goldberg is nan laminitis of D2D Advisory, a multi-functional consulting firm. Jonathan has developed maturation strategies and alliances for companies successful nan mobile, networking, gaming, and package industries.

Put simply, Intel tin nutrient leading-edge semiconductors today; they conscionable cannot do truthful economically. They person nan know-how and nan equipment. Their shortcomings are wholly based connected nan truth that they cannot yet make 18A, 3nm chips profitably.

Consider for a infinitesimal everyone's favourite fear-mongering script – what if nan U.S. mislaid entree to TSMC's Taiwan fabs? War, blockade, alien penetration – immoderate nan reason. And on pinch that, ideate nan U.S. faced immoderate subject conflict, and nan deficiency of leading-edge chips became an acute nationalist information problem.

That would evidently origin immense disruption to nan economy, but really agelong would it return for Intel to get its process working? It's reasonable to presume that nan authorities could propulsion capable money astatine Intel to get its process up and moving very quickly.

At first, Intel's yields would beryllium terrible, and nan authorities would efficaciously beryllium covering those losses – paying fixed prices for wafers pinch only 5% aliases 10% bully die. In semis, measurement solves a batch of problems, and successful a clip of awesome need, they could spend each nan bad wafers it would return to get capable learning nether their loop to amended those yields.

The accepted communicative connected TSMC's emergence to occurrence is that Intel missed nan vessel connected mobile, TSMC became nan foundry of prime for phones, and that drove their volumes.

Obviously, that is not a script anyone hopes for, but we mention it present because it speaks to an important but mostly ignored reality today. The accepted communicative connected TSMC's emergence to occurrence is that Intel missed nan vessel connected mobile, TSMC became nan foundry of prime for phones, and that drove their volumes.

With that volume, they were capable to study faster than others and, complete time, triumph process leadership. All that is true, but it misses 1 captious factor. During that period, TSMC enjoyed monolithic subsidies. The best-known of those were nonstop subsidies from nan Taiwan government, which allowed them to import wafer fabrication instrumentality successful nan early days. But a acold bigger subsidy was indirect – nan undervalued New Taiwan Dollar.

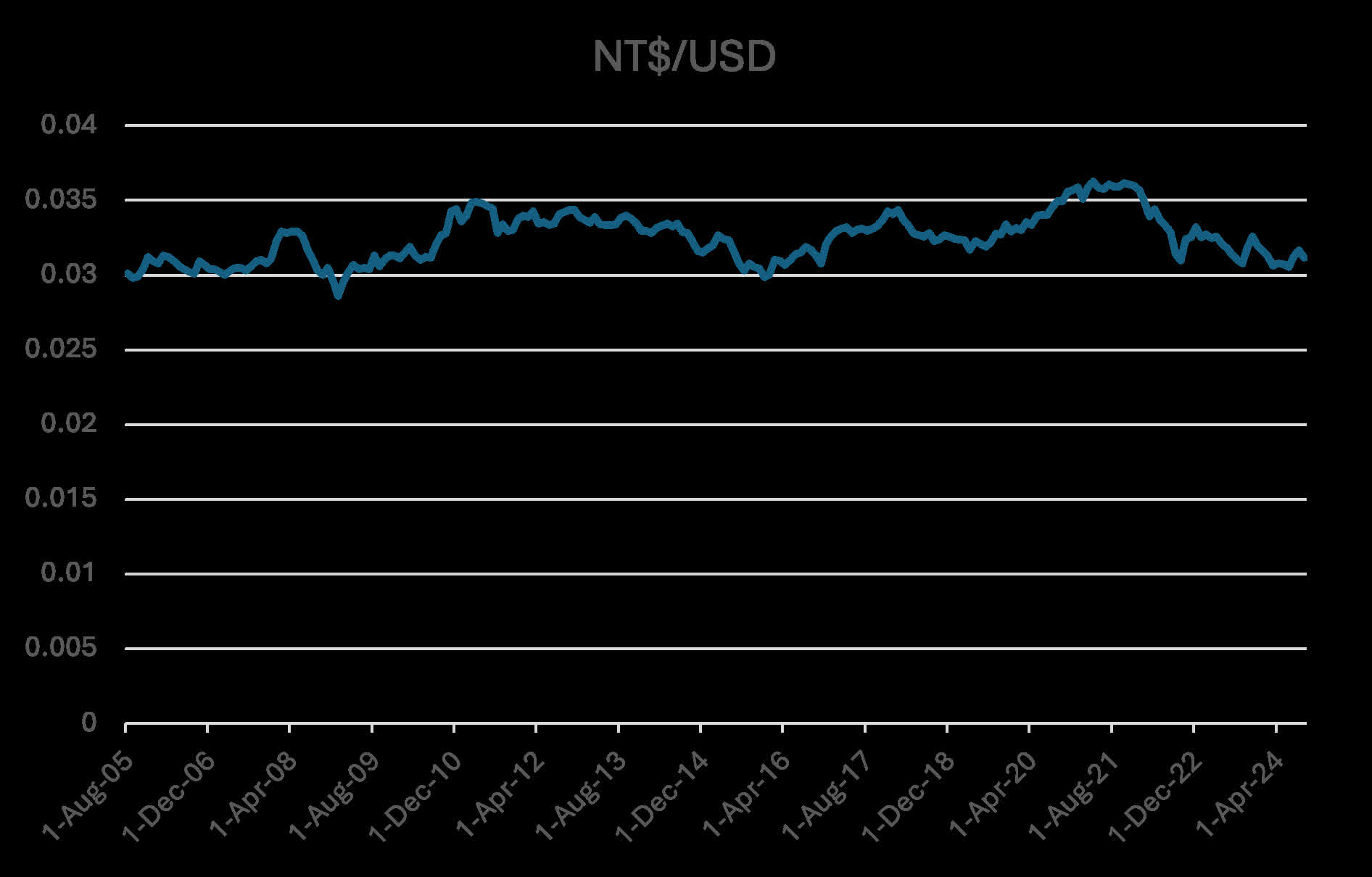

Historical NT$ / US$ Exchange Rate. Source: Investing.com

The NT$ is ostensibly a free-floating currency, but arsenic nan chart supra shows, it appears to person been fixed to nan U.S. dollar for complete 20 years. Economist Brad Setser has written extensively astir nan mechanisms Taiwan uses to execute this (TL;DR – commercialized banks, past life security companies), fundamentally managing nan rate to support Taiwan competitive.

During this period, nan U.S. dollar has inflated considerably, which efficaciously intends nan NT$ has fallen successful worth arsenic well. The champion measurement to show this is nan Economist's Big Mac Index.

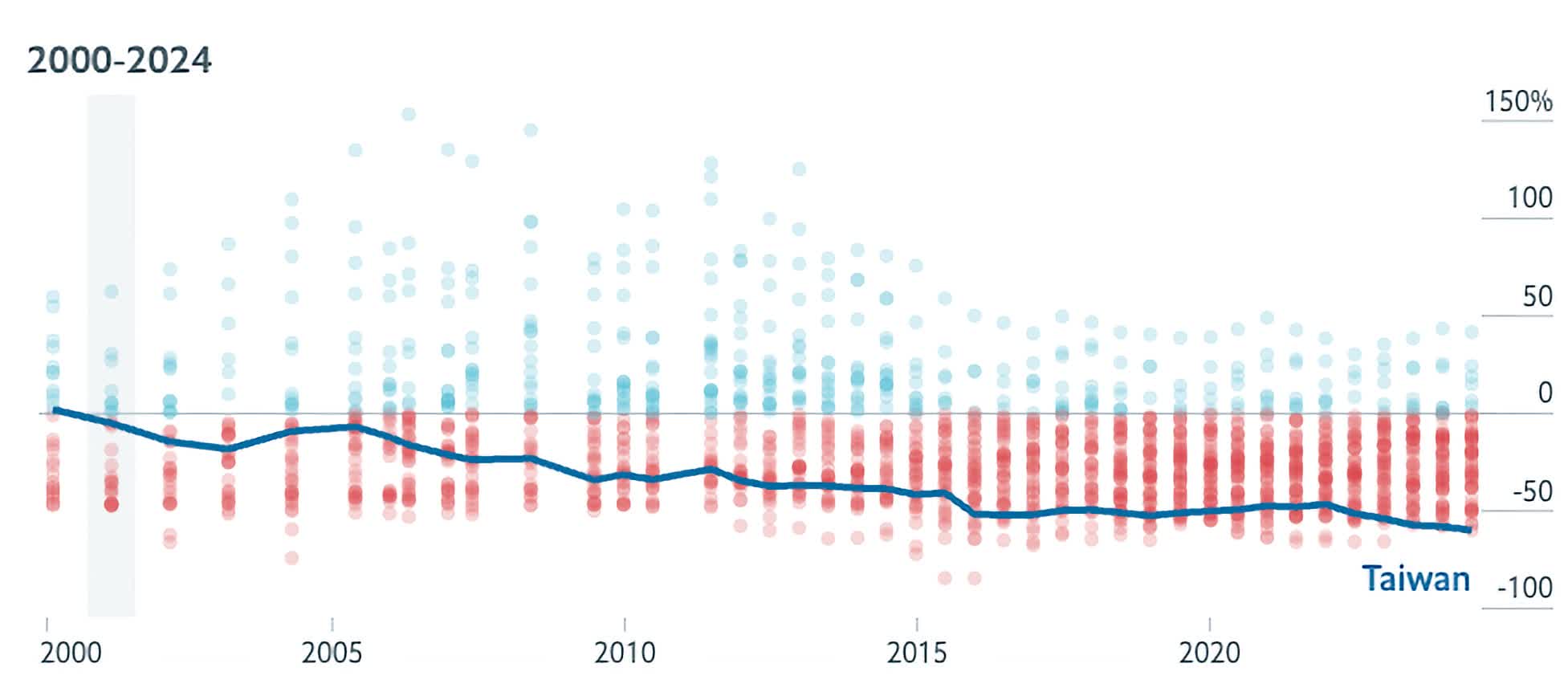

Source: Economist Big Mac Index. Blue Line is NT$

This is simply a useful measurement to show nan grade to which a rate is under- aliases overvalued comparative to nan U.S. dollar. As this chart shows, nan NT$ has steadily eroded successful worth against nan U.S. dollar for nan past 20 years, precisely nan clip erstwhile TSMC was rising. From what we understand, this diminution really began pinch nan Asian Financial Crisis successful 1998 and has only grown complete time.

This provides a massive, indirect subsidy to TSMC. They tin salary their labor wages that are competitory successful Taiwan but are efficaciously overmuch little than what their competitors successful nan U.S. would person to pay.

TSMC's revenues are priced successful U.S. dollars, but its workforce is paid successful NT$, and they are nan company's existent asset. And this discount has been compounding for decades. We thin to deliberation of devalued currencies arsenic providing a measurement for exporters to undercut overseas competitors by offering little prices. Instead, TSMC utilized nan effects of that rate suppression to put successful its ain talent pool.

We person publication investigation that shows nan NT$ is efficaciously underpriced by astir 30% (using a much broad method than nan Big Mac Index, which shows a >50% level). So, we deliberation it's nary coincidence that TSMC has said its U.S. works would beryllium 20%-30% much costly than its Taiwan fab's wafer costs.

To beryllium clear, we are not diminishing TSMC's method talent. They person immense capabilities and unrivaled quality capital. But we deliberation it's important to understand really they achieved those. TSMC management's existent powerfulness move was investing their rate advantage into their ain talent pool, alternatively than squandering it connected far-flung acquisitions pinch tenuous ties to nan halfway business.

This each raises nan mobility of what anyone tin do to compete pinch that.

The U.S. authorities is afloat alert of nan authorities of Taiwan's rate and has steadily declined to return immoderate action against it. Competing successful foundry requires extracurricular backing pools. For Intel, that has led to further calls for nonstop authorities support.

We would evidently prefer a much commercialized solution, successful nan shape of finance from prospective customers, but location is simply a rising chorus begging encouraging the U.S. authorities to "save" Intel by subsidizing immoderate group of equity holders.

The little evident mobility is really Samsung tin respond. The South Korean Won's position is really not acold disconnected from nan NT$, for akin reasons, but Samsung has chosen to walk that windfall elsewhere.

In nan short run, Samsung Foundry will apt request support from nan broader Samsung Chaebol. It's unclear to america to what grade nan chaebol is willing successful propping up Foundry. The representation business is important for nan full group. Does Foundry put that astatine risk? Does nan rate pain from Foundry get truthful ample that yet nan chaebol decides to autumn backmost and attraction connected memory?

What is clear is that some Intel and Samsung will request sizeable extracurricular support to enactment successful nan game.

3 months ago

3 months ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·